PRSI Aged 66 to 70

PRSI changes to Employees aged between 66 and 70

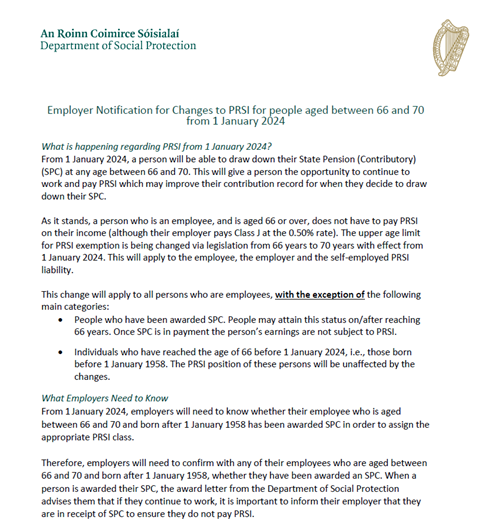

Since January 2024, employees have the option of drawing down the State Contributory Pension at any age between 66 and 70. This allows some employees that to continute working past 65 and accumulate more PRSI contributions if this is more beneficial for them. The employee and employer PRSI contributions remain the unchanged. This is the new default position.

However were an employee has drawn their State Contributory Pension and continues to work, then no employee PRSI deductions are required. The employee will, however, need to forward a copy of the letter they received from the Department of Social Protection (DSP), so the pyaroll office can cease deducating the employee PRSI contributions.

In summary if you will be receiving your state contributory pension from age 66, can you please forward letter from DSP as proof to payroll. If we don’t receive a letter will take it that you are deferring your pension and your PRSI class will remain unchanged.

A copy of the correspondence from the Department of Social Protection is included below.

Please forward letters and/or any queries to:

Weekly payroll : carolineN.fitzgerald@mtu.ie

Monthly payroll: deirdreM.collins@mtu.ie